Understanding Cashless and Reimbursement Claims in Health Insurance

11/28/20252 min read

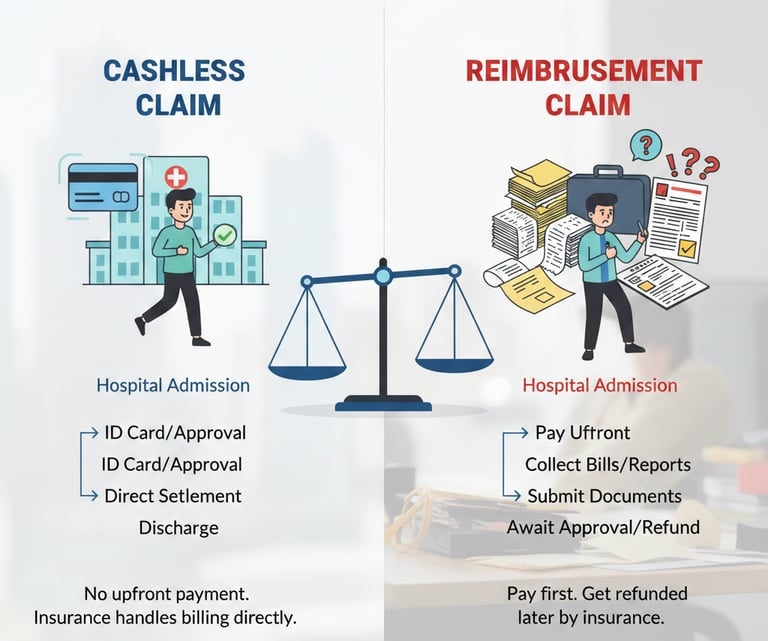

Understanding Cashless and Reimbursement Claim:

These two words are associated with Insurance claim, primarily Health Insurance. We buy health insurance to tackle the uncertainty in Life, be it Health, Life or General. Here we will talk mainly Health Insurance.

We buy health Insurance but many of us are unaware of Health Insurance Terminologies like Cashless, Reimbursement, pre-existing disease, Waiting Period, Porting etc. This blog will break down the understanding about types of claims, its benefits, limitations, clauses. Let’s clear confusion about Cashless V/S Reimbursement.

What is Cashless Claim?

In simple term, if you have a health insurance policy then only u can take benefit of Cashless claim. In event of Hospitalization, if you have a health policy in your name, you can get treatment without paying any money subject to per policy terms and conditions, that is called Cashless Treatment or Cashless Claim. Here your treatment cost is paid by your insurance company not by you as per policy terms and condition.

How to get Cashless claim?

To get cashless benefit, first of all 24 hours of hospitalization is mandatory barring few treatments of day care.

· Hospital has to be a Network hospital.

· You should have valid health policy.

· Cashless services only start once same is approved by your Insurance Company

· On discharge Insurance company approved the bills directly to Hospital

· You pay only non-covered items.

Pros of Cashless Claim:

· No need to arrange Money in case of Health Emergency

· Lower/No Financial burden

· Hospital & Insurance company coordinates directly

Cons of Cashless Claim:

· Can be availed only in Network/Empaneled Hospital

· Some procedures may be partially approved

· Pre Hospitalization/Non-Medical Expences are not covered

· In case of non-approval of Cashless immediate financial burden comes

Emergency situation never waits for money. Always take pre-approved cashless for planned hospitalization

About Reimbursement Claim:

When you pay your hospitalization bills first, take your treatment and claim it to your Health Insurance Company after dischnage from hopsital by submitting the original hospitalization documents along with bills and other documents. After documents verification insurance company credit the amount in your bank account /Cheq. subject to policy terms and conditions.

Prs of Reimbursement Claim

· Choose your own hospital as per your convenience

· Take Treatment in the best hospital

· You go ahead even if cashless is denied

Cons of Reimbursement Claim

· Financial burden

· Documentation formalities

· Some time delay in payment

· Short settlement of claim

· Change of rejection due to missing documents

Too much follow-up with Insurance companies

Which one too choose:

Both have their own advantages; you can opt based on your circumstances

Choose Cashless if:

· If you want Quick and stress-free hospitalization

· Minimal Paper work

· Don’t want any financial burden

· If Network hospital near by

Choose Reimbursement if:·

Your preferred hospital is non-Network

· Cashless denied due to documentation/technical issue

· Planned hospitalization is of your choice hospital

· Specialized treatment is not available in non-network hospital

· Network hospital is very far from your location

Yes, now to avail these services you should have these documents with you

· An active health Insurance policy, not lapse

· KYC documents

· Dr. prescription

· All past medical records

· Immediately Infirm your Insurer

Key Takeaways:

Cashless Claim give freedom of financial burden with minimum upfront payment

Cashless claim is faster

Reimbursement Claim give flexibility to choose your hospital

Always check Room category while hospitalization as per your policy terms and conditions, hospital tariff is dependent on Room Category.

These views expressed here is personal may differ from Insurance’s and hospital’s policy., it is essential to be aware with the policy wordings and clauses which impacts claim approvals.

claims360

© 2025. All rights reserved.

Follow us

Add.-702,platino F,Lodha Splendora,GB Road , Thane west-400615

About us

We offer faster claim support guidance for your Rejected Insurance claim, Ombudsman, Insurance Grievance,Cashless,Rejeted death claims and Reimbursement claims along with other Insurance support service

Email-care@claims360.in

Claim Assistance